Notes on The Permanent Portfolio

Rome, Italy – March 2016

I took the photo above shortly before falling asleep at a table across the street. It was a beautiful spring evening. We’d been rocketed the morning before in Afghanistan, and a day later, I was sitting outside a cafe in Rome, admiring the beauty and permanence which had existed through two millennia. Sitting there drinking wine, a breeze gently rustling the awning above me, the low murmurs in Italian as people strolled by enjoying the evening, the stress ebbed out of me, and no longer responsible for hundreds of lives, I dozed off at the table surrounded by enduring beauty.

Krakow, Poland - October 2023

Same continent, a different war, years later, I’m sitting in a hotel lounge working on these notes as the large flatscreen tv opposite the bar shows the latest scenes out of an endless war starting to be rekindled thanks to the horrendous attacks in Israel.

The war we are here for to our east, forgotten in a day as an all too familiar war horn blares, calling the faithful on both sides, each convicted in the righteousness of their banner, to battle.

The 50” Samsung hanging on the wall doesn’t do industrial warfare justice. You don’t get the scent of burnt hot dogs that were people moments ago mixed with the acidic smoke of spent munitions and the taste of chalk in your mouth from dust like powdered sugar lingering in the air.

After three war zones in less than two decades plus a conflict zone in Africa, there is nothing new for me on that tv. I look out the window, thinking about the walk I went on earlier, listening to my notes on The Permanent Portfolio: Harry Browne’s long-term investment strategy by Craig Rowland.

Fall is in the air here now, leaves are on the ground in the park, rain lightly falling, almost a mist, now cold enough to see my breath as I pushed my hands deeper into my coat pockets and hugged it unbuttoned around me, walking along the river below Krakow Castle and thinking about Permanence.

Permanence requires a kind of detachment to events happening around me. There is always a reason to not build for the long term, the world is always ending somewhere. Permanence doesn’t mean escaping volatility unscathed, only enduring through it and continuing to build.

This detachment is not a lack of caring, quite the opposite, it is caring deeply about long-term survival enough to know I can’t predict when it will be my turn to deal with volatility. The best I can do is build for the future, have concentric rings of security around my life, realize it will never go the way I think it will, and have fun along the way.

I look back at the scenes on the TV again and take a sip of Perrier.

You definitely can’t substitute bonds in the permanent portfolio for commercial real estate in Gaza, I thought, watching another JDAM slam into a building, homes collapsing into rubble as retribution for other homes being violated.

I think about the Keizer writing the Austrian Hungarian Empire a blank check against the Serbs in the summer of 1914 and wonder if anyone at the policy level has concerns about our current check writing for Israel or the other fronts we’re supporting in Europe, Africa, and Asia.

Then, thinking about Napoleon’s definition of a military genius, the man who can do the average thing while everyone else around him is losing their minds, I reach up, switch on my noise cancelling headphones and firmly turn my thoughts back to my notes on the permanent portfolio.

These notes are my thoughts on a Permanent Portfolio, as originally laid out by Harry Browne, consisting of 25% stocks, 25% long term treasury bonds, 25% cash, and 25% gold.

Most of the notes are from Craig Rowland and J.M. Lawson’s book, The Permanent Portfolio, which focuses on how an individual can implement the portfolio themselves. Also included are some notes from Gavekal, and Dylan Grice, who also did research on the permanent portfolio.

The Permanent Portfolio is not new, Bridgewater’s all-weather portfolio is similar to the permanent portfolio, and 1,500 years before us, the Talmud portfolio proposed a man should divide his wealth into three things, business, land, and to keep a third in reserve, with King Solomon going even further and saying 3,000 years ago in Ecclesiastes to divide your wealth by seven or even eight since you don’t know what disaster may happen on the earth.

All of these views on how to allocate savings a person cannot afford to lose have a common theme; being simple, safe, and stable.

Those three things, simple, safe, and stable are the foundation of Harry Browne’s thoughts on what a permanent portfolio should be.

A permanent portfolio should protect against all economic futures while also providing steady real returns, and it should be easy to implement, something an individual can do on their own.

There are many ways to approach investing that is simple, safe, and stable, but Browne recommends holding 25% in stocks, 25% in long-term treasury bonds, 25% in gold, and 25% in cash, or short-term savings bonds.

This 25% approach to these four asset classes is to cover the investor for every potential market an investor could find himself in whether economic expansion where stocks do well, deflation where bonds perform, economic recession where cash is king, or gold for inflation.

Browne’s 16 rules for embracing market uncertainty while growing and protecting savings.

1. Your career/business provides your wealth.

2. Don’t assume you can replace your wealth.

3. Recognize the difference between investing and speculating.

4. No one can predict the future.

5. No one can time the market.

6. No trading system will work as well in the future as it did in the past.

7. Don’t use leverage.

8. Don’t let anyone make your decisions.

9. Don’t ever do anything you don’t understand.

10. Don’t depend on any one investment, institution, or person for your safety.

11. Create a bulletproof portfolio for protection.

12. Speculate only with money you can afford to lose.

13. Keep some assets outside the country in which you live.

14. Beware of tax avoidance schemes.

15. Enjoy yourself with a budget for pleasure.

16. Whenever in doubt on a course of action, better to err on the side of safety.

The appeal of a permanent portfolio for me is I can implement it myself, and it takes human emotion into account. Most millennials, my age bracket, will look at a 25% stock allocation and scoff, saying this will drastically underperform the S&P500. This is true, but consider a few things.

First, as Gavekal points out, the permanent portfolio (they call it the rentier portfolio, or the stay rich, not the get rich portfolio) is designed to replace a bond portfolio.

It is not designed to replace a business or investing in businesses. It does this by giving real returns that beat a bond portfolio with bond like volatility for the overall portfolio while the underlying assets are volatile.

Then there is ergodicity, mistakenly thinking we as individuals will get the average performance for the group in games of absolute individual risk.

People don’t consider what will happen if the market is down when they need their money, or what happens when they hit sell and realize a 30% loss since Bill Ackman is screaming we are all going to die on CNBC in early 2020 while he is shorting for a $2 billion profit.

Best article explaining ergodicity: https://taylorpearson.me/ergodicity/

Twenty years of results shows the average investor doesn’t get average market returns.

N. Scott Prichard also did research from 1988-2007. S&P returned 11.81%, yet average investor return was 4.48%, even less than 30 day treasury bills.

Large losses or gains can happen at any time. Permanent portfolio embraces volatility in the underlying four assets for an overall portfolio return with low volatility relative to bonds.

One of the largest obstacles for an investor to overcome is to not focus on individual asset performance instead of the overall portfolio. Understand how each asset performs within the portfolio, why it is there, and focus on overall portfolio performance.

It is not necessary to like each individual asset to be a successful permanent portfolio investor. (US treasury bonds for me) I need to keep in mind it is the total portfolio that provides the growth and safety.

Many investors have experienced over a decade of negative real returns, even though models on which their investment decisions are based suggested US stock market should have been returning around 10% on average. While long-term the average return might suggest one thing, there is no promise that average return will be there when you need it in your personal life.

Meanwhile, a permanent portfolio has done well with low overall portfolio volatility. Overall Portfolio volatility being low is good because it keeps us from doing drastic things which would be to our own long-term detriment when we get scared by events or emotions.

The idea that investors should build diversified portfolios is based on the idea by allocating funds between different investments, no one single event can wipe out half of their wealth or more. It sounds simple, but takes thought to implement. The 2008 GFC revealed many cases of simulated diversification that was not diversification at all in times of volatility.

When diversification fails it is normally related to several key factors: the strategy took too much risk in a single asset class, the portfolio held assets exposed to the same type of risks, there were false assumptions about asset class correlation within the portfolio, and the portfolio held no hard assets.

An asset class moves up and down in price for very specific reasons related to what is going on in the overall economy. Be careful about looking at holding one asset because it is correlated or not correlated to another asset over a time period. Correlation changes over time.

Case in point with US stocks and bonds. From 1990-1999, US stocks and US long term bonds were positively correlated, so people thought there was no reason to hold bonds in their portfolio. They then missed out on the diversification power of bonds from 2000-2009.

Know why I hold an asset and what I expect it to do within the overall portfolio. Do not hold an asset because I think it is correlated or not correlated to one other asset.

Most assets held by investors are paper assets, essentially someone else’s promise, like a promise to pay back a debt in the future, bonds, or a promise of ownership of an asset under someone else’s control, stocks.

Hard assets on the other hand are assets which can be owned or held by the individual and retains value independent of a currency or what paper assets may be doing. A hard asset can be something like gold bullion, or something more involved, like real estate, that an investor can use to generate income.

Hard assets do not perform like paper assets, and in some economic conditions, are the only assets which can protect an investor when other paper assets like currency, stocks, and bonds are performing poorly.

Cash is similar to hard assets in that most people don’t own enough of it and don’t view it as an investment allocation. Yet when the markets are doing poorly cash provides needed stability and liquidity. In those moments of market volatility when liquidity is receding, cash is king.

The only way to achieve a diversified portfolio is to own assets where not everything is going up at the same time, since things which move up at the same time, can all move down at the same time as well. Get used to owning assets which do not all perform well at the same time and stay focused on the overall portfolio performance and volatility instead of the individual asset performance and volatility.

When thinking about the problem of developing a true all-weather portfolio, it is necessary to think of situations which do not look likely at the time. Reading history and thinking in concentric rings of security around my life can help in this regard, where one asset may protect against one situation but not do well in another situation. That doesn’t mean it is a bad asset, it just means it needs to be sized appropriately and other assets used to guard against other situations where that particular asset does not do well.

When it comes to economic matters, the future is simply uncertain.

Use multiple brokerages or companies to hold assets for institutional diversification. While this may seem to add complexity, it really does not, it does not take that much time to check accounts, and provides institutional diversification so not all assets are held by one institution in one jurisdiction.

Go all in or wait? Waiting is a euphemism for market timing. Going all in will provide some level of diversification and protection now for the future.

Turnoff automatic reinvest of interest and dividends. This distorts the rebalancing bands of the portfolio. Put all income into cash position, and then use cashflow to rebalance. This could also help on making the portfolio more tax efficient.

Growing into an overseas gold storage option. Book mentions using different accounts for stocks, I use Interactive Brokers, and bonds and cash, I’m setting up a TreasuryDirect account for myself when back from this TDY, then buying physical gold. Can then grow into an overseas storage option.

I’ve been looking at Matterhorn Asset Management, there are other companies, the book mentions some. With Matterhorn, have the ability to ship existing precious metals to them, so buying physical and then growing into overseas storage is an option. Whoever I end up choosing to go with for overseas storage, that will most likely need to be an option unless I decide to sell a portion of bitcoin in the future and just go straight to overseas storage, which I might do.

I’m not trying to get into a bitcoin or gold debate, simply talking about what I am thinking.

But why am I thinking about potentially selling some bitcoin in the future for gold?

They behave different and gold is the historically proven, globally accepted, asset of central banks and sovereigns when there is political, currency, or conflict risk and no one trusts each other, and only an asset without counterparty risk will do. Bitcoin is not there yet.

On a personal level, it is also not lost on me I can take an account statement showing $500,000 in gold held at Matterhorn Asset Management and a loan officer will accept it, from experience, they do not accept bitcoin for underwriting.

Concerning holding gold outside the US since my other assets are denominated in dollars and held in the US, I am currently reading How States Think: The Rationality of Foreign Policy by John Mearsheimer.

Similar to how individual investors have to make decisions in the present for an uncertain future, so to do nation states. From foreign policy, to war, to decisions for social stability, policy makers are making decisions without all the facts they want.

Their world is filled with uncertainty, as is ours as individual investors making decisions on the best way to preserve and grow our savings. I have no idea if fiscal dominance will happen in the future as Charles Calomiris lays out or financial repression will play out the way Russell Napier thinks, no one does. What I do know is physical gold held outside the US since I am US focused provides me with an insurance policy against an uncertain future at both the individual level and nation state level.

The permanent portfolio says to only rebalance once a year between the four assets, stocks, long duration bonds, gold, and cash. If emotionally possible, then don’t do that, and instead only rebalance when one of the four assets gets to be less than 15% of the portfolio, or greater than 35% of the portfolio.

If that happens, then rebalance all four assets to 25% each of the portfolio. For someone like myself as an individual investor rebalancing with cashflow to the extent possible would add more tax efficiency.

It is rare to need to rebalance more than once a year. The book says what happens most of the time is one asset grows to be more than 35% of the portfolio rather than falling to be less than 15% of the portfolio, triggering a rebalance.

Either way, rebalancing only when one asset is more than 35% or less than 15% forces me to sell high and buy low, and not overthink it or worry about what is happening around me in the moment.

The hard part is going to be doing nothing for long stretches of time besides adding in more cashflow. Staying disciplined is very hard. Especially when two giant industries, the media and wall street, are built on making me do something all the time.

Harry Browne recommends putting money into the cash portion of the portfolio until cash reaches 35% and then rebalancing across the portfolio. However a tactic that might result in slightly better performance is put money into the worst performing asset in the portfolio until it reaches 25%, and then repeat. Doing this is forcing myself to constantly buy low while using cashflow to rebalance so the portfolio has better tax efficiency with also better long term performance.

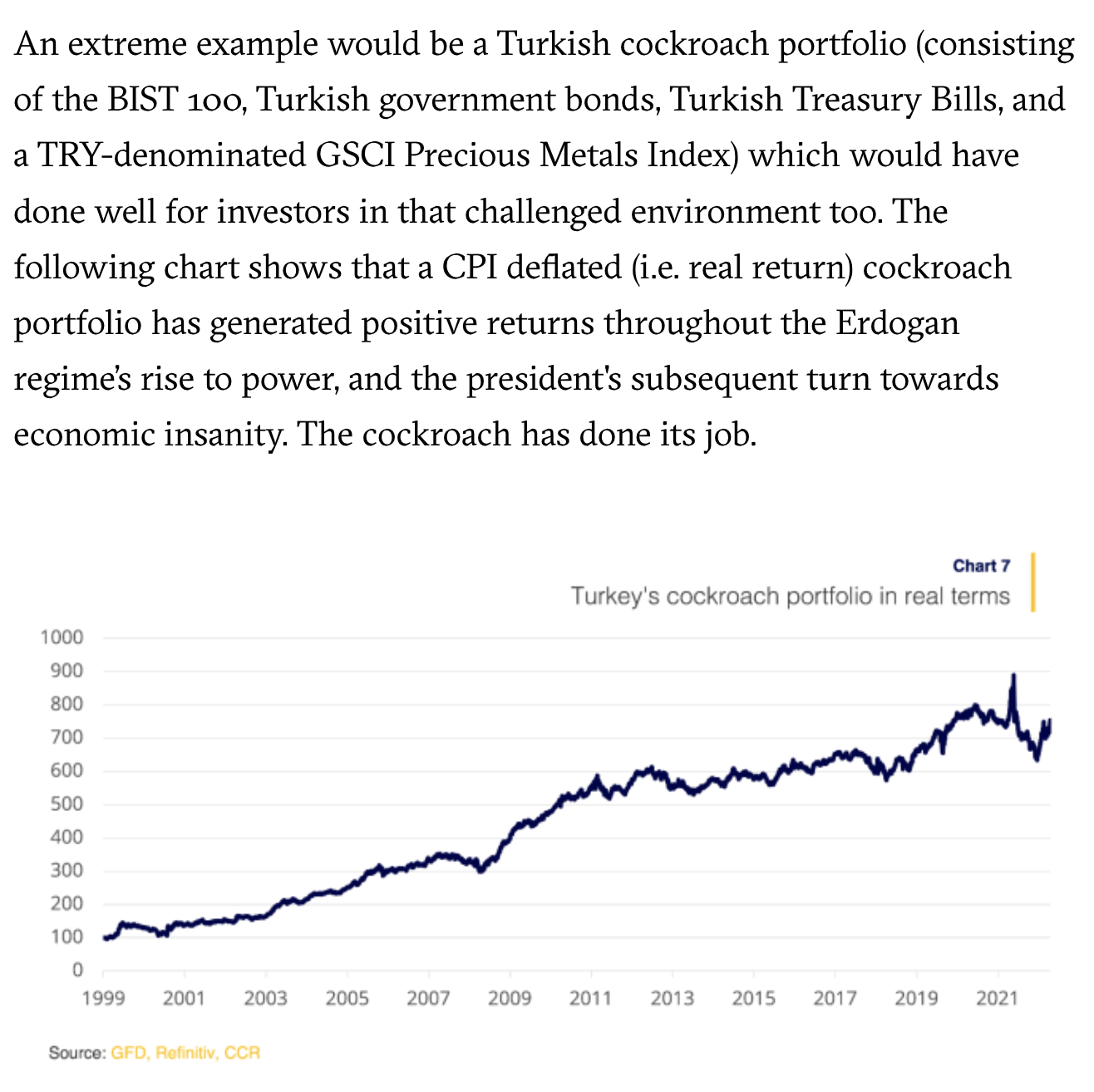

There are people that implement the permanent portfolio all over the world. The portfolio is designed to work within your economy. It has even worked in Turkey in recent years, despite the persistent inflation people have been suffering from.

Concentrating the permanent portfolio where you live and work prevents you being negatively impacted from currency fluctuations, foreign economic problems, and foreign political decisions.

US policies are designed to benefit the US economy, same as any other country in the world, so economic cycles in one country won’t necessarily match up with other countries.

“What is your natural long position and natural short position? Your default move is to cover your natural short position.”

– JimBud in the Fortress Discord helping me think about currency risk as an individual investor.

I’m not looking to introduce currency risk into the permanent portfolio that is supposed to be a substitute for a bond portfolio and able to withstand all economic conditions.

If I want to express a long-term view of US sovereign debt or dollars in another investment, fine, this is just not the place for it. Below example shows how this works in Turkey from Dylan Grice.

https://themarket.ch/english/the-cockroach-portfolio-still-dumb-still-robust-still-superior-ld.7901

Paying the smallest allowable taxes should be the goal of every investor. Simple portfolios are less likely to get dragged into complicated tax planning schemes that can be changed in the future and potentially expensive to adjust.

The Permanent Portfolio is designed to be a separate pool of capital from any pension or government benefit. Do not use your pension as part of the permanent portfolio (damn, guilty of that for the long bond allocation). The Permanent Portfolio is designed to be insurance against something that can go wrong in the future, including with pensions or government promised benefits.

MF Global and the missing $600 million from custodial accounts. The simplest way to protect myself against asset manager’s mistakes, problems, fraud, and failure is to diversify assets across different asset managers. Some of the smartest and most sophisticated investors on the planet lost with LTCM, MF Global, Bear Stearns, and Bernie Madoff. Massive losses aren’t just for crypto bros. Protect yourself.

The Permanent Portfolio is designed to replace a bond portfolio and hold savings which cannot be lost. It is not designed to replace investing in equities, taking risk when there is an opportunity, or businesses. When truly have extra money and know can lose it and still be ok, it can be liberating to look for opportunities to grow wealth.

If have a burning desire to be an owner in a certain company or own real estate, do it, but it is not a replacement for the permanent portfolio, it is a different allocation in the personal capital stack. The key is to not allocate more than comfortable if things do not turn out as expected.

Geographical diversification, the simple act of not holding all of our assets in the same jurisdiction where we live, is no longer easily accomplished for Americans. This type of diversification is designed to protect from nearly anything, from major natural disasters that disrupt the financial markets where you live, to government actions aimed at confiscating property held within the country’s borders through fiscal dominance or financial repression.

Physical gold is the best asset to keep in a foreign account since it is easily stored, it does not pay interest or dividends so there are fewer accounting issues, it rarely needs to be rebalanced, and it is the most liquid asset on the planet in a true emergency. Everyone from central bankers to warlords likes gold during volatile times.

Of the four assets in the permanent portfolio, gold works the best. Are there other types of geographical diversification like having a second passport and a house overseas? Absolutely, but those aren’t part of the permanent portfolio even though they will likely be things I work towards as part of my personal plan for the right amount of geographical diversification for me.

Disclose assets. Even if gov knows of the account doesn’t matter. Will have few transactions, so doesn’t generate much in taxes.

Conclusion

I’ve been looking at treasury bonds hard lately. How can I not when they are down over 50%?

Yet I am conflicted. I don’t like the idea of buying US government debt for a variety of reasons, but I also know firsthand the machine that is the US government and people will justify anything if it keeps them safe and comfortable.

Not liking the reality of something and being short are two totally different things.

So I like the permanent portfolio is designed to be a substitute for a bond portfolio. It helps me buy treasury bonds in a way that is emotionally palatable to me. I can buy 25% long treasury bonds and build a portfolio that is better than holding 100% treasury bonds.

The permanent portfolio also helps me hedge against simply buying the S&P500 and hoping for the best while in my mind I scream at myself that hope isn’t a strategy.

I also like the idea of eventually working towards having physical gold stored overseas and even the cash position because life never goes the way you expect it to and permanence in my mind is not about avoiding volatility but being able to endure through it and keep building.

See you out there, Radigan